In times of economic uncertainty and market turbulence, it’s natural for many investors to feel anxious and seek to minimize risk. However, there exists a cohort of seasoned investors who often increase their investments during crises. What drives them to act contrary to the majority? Let’s delve into their rationale and strategies.

Historical Perspectives and Lessons Learned

Experienced investors understand the cyclical nature of financial markets. History has shown multiple economic crises that resulted in significant market downturns followed by eventual recoveries. Those who had the courage to invest during these downturns were often rewarded handsomely when the markets rebounded. For example, investors who purchased stocks during the financial crisis of 2008-2009 witnessed substantial gains as the markets recovered in subsequent years.

The Principle of “Buying Low”

One of the main strategies employed by seasoned investors is “buying low.” During crises, the prices of stocks and other assets often drop significantly below their intrinsic value. By purchasing during these times, investors can acquire high-quality assets at a fraction of their usual price.

Diversification and Risk Management Strategies

Seasoned investors also know how to effectively diversify their portfolios to minimize risk. Investing during a crisis doesn’t mean betting everything on a single asset. Instead, they spread their investments across various asset classes and sectors, thereby reducing overall risk. For instance, they might invest in a mix of stocks, bonds, real estate, and alternative assets such as commodities or cryptocurrencies. This diversification allows them to capitalize on opportunities in different areas that may react differently to the crisis.

Patience and Long-term Outlook

Another crucial factor is patience. Seasoned investors have a long-term investment horizon and are willing to wait for their investments to recover. They do not panic during short-term downturns but remain confident in the long-term value of their investments.

The Psychological Advantage of Experience

Experienced investors also possess a psychological edge. They view crises as opportunities rather than threats. Their experience and knowledge enable them to make informed decisions and avoid emotional reactions. They understand that markets are driven by emotions and that panic selling often leads to unnecessary losses.

Access to Information and Analysis

Seasoned investors have access to advanced information and analytical tools. They can utilize detailed financial analyses, market forecasts, and expert advice to identify the best investment opportunities during a crisis.

Utilizing Financial Instruments and Strategies

Experienced investors also know how to use various financial instruments and strategies to maximize their returns. They might use options to protect their investments or leverage products to increase potential gains. These tools enable them to gain an advantage even in unstable market conditions.

Why Experienced Investors Invest During Crises

Historically, all crises have impacted stock markets. It is true that losses during a crisis can be significant, but history shows that every downturn in the stock markets has been temporary. Most people, when they see their investment value dropping, begin to panic and sell their shares. A savvy investor, however, buys as the stock markets decline and holds or sells their shares during the rise.

If you are deciding whether to invest or not, the factor of a crisis should be negligible because market declines in the short term represent significant losses in your investment accounts, but from a long-term perspective, the crisis factor is negligible.

Don’t Wait for the Perfect Moment

Based on real historical data from past years, waiting for the “right moment” to invest is usually the worse option. Generally, this means that if you time the market during high volatility based on daily or weekly changes, you have a relatively low chance of success.

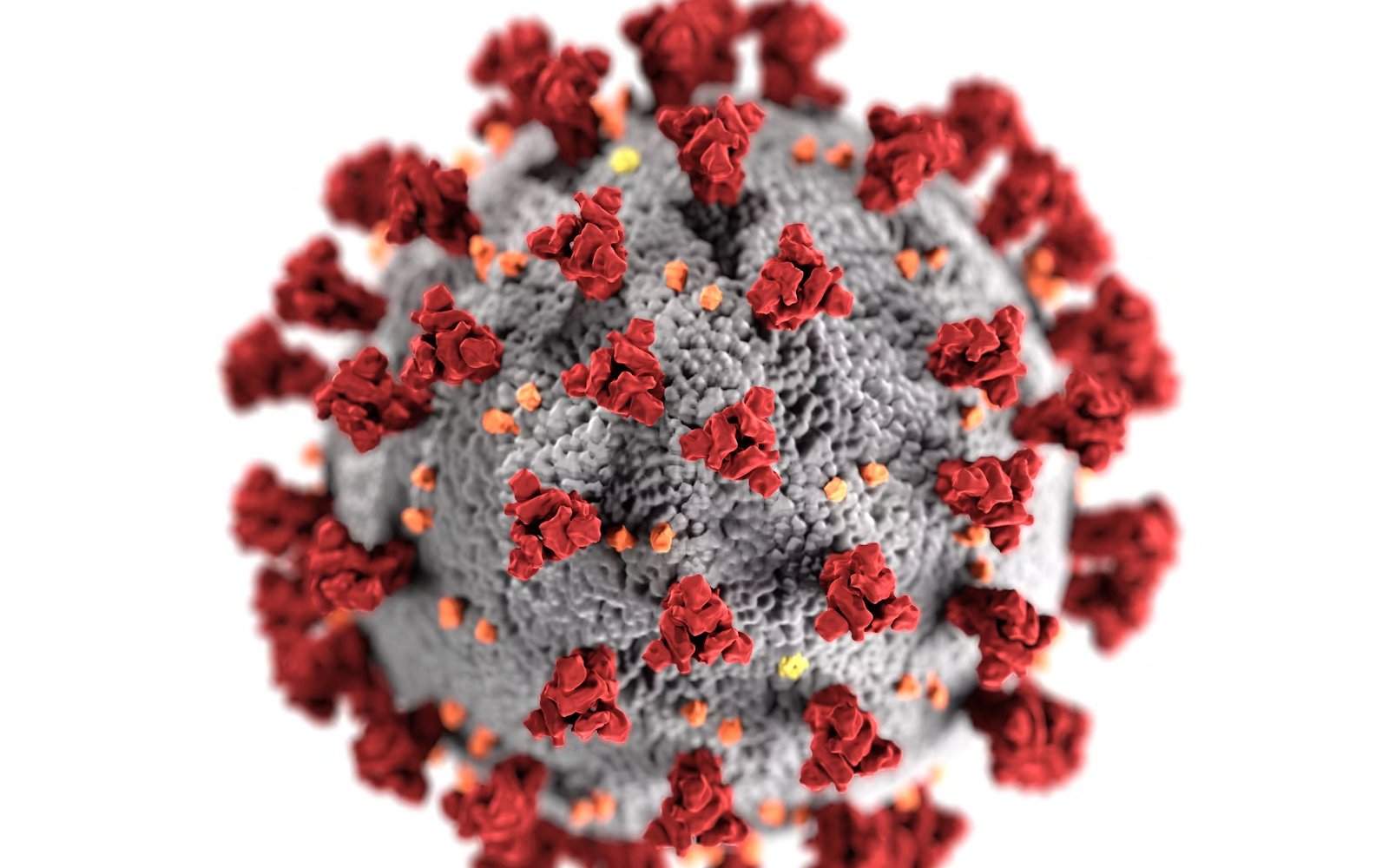

If you have money available to invest today, it doesn’t make sense to wait for the crisis to end completely. If you already have your funds invested, it’s important to remain calm and not sell your investments. Market downturns caused by economic or geopolitical factors, or events similar to the COVID-19 crisis, happen regularly. Experienced investors know not to worry because they see higher future gains behind the declines.

What Products to Invest in During a Crisis

The main factor in investing in financial markets is a well-chosen investment strategy that should be followed even in turbulent times. Investments should be carefully diversified across various sectors, spread into different assets like stocks, bonds, funds, or gold.

When deciding which investment products to invest in, it’s important to set a goal and a time horizon for your investments. There are many investment options available. You can choose from various products such as managed portfolios, investing in ETF funds and open-end mutual funds, or more conservative assets like bonds and gold.